Leveraging Business Intelligence for Healthcare Management

How can organizations leverage business intelligence for healthcare management? What are the first steps for engaging in financial and clinical improvement efforts?

Source: Thinkstock

- Considering that the phrase “value-based care” is almost always immediately followed by a discussion about how to trim inefficiencies and improve patient outcomes, few industries are more in need of comprehensive insight into their operations than the healthcare sector.

Business intelligence, defined by Gartner as “an umbrella term that includes the applications, infrastructure and tools, and best practices that enable access to and analysis of information to improve and optimize decisions and performance,” is essential for helping healthcare providers gain visibility into opportunities for improvement.

As with so many other industry buzzwords, however, such an all-encompassing definition is unhelpfully broad. Healthcare organizations have very quickly learned that they cannot simply snap their fingers and instantly access all of the data, reporting, and decision support they need to foster an intelligent business.

Instead, they must take a measured, piece-by-piece approach to the synthesis and analysis of clinical, financial, and operational data in order to produce actionable insights into performance and profits.

What are the key components of architecting a successful business intelligence strategy and how can healthcare organizations create the initiatives they need to succeed in a highly competitive environment?

Creating a roadmap and generating buy-in

Healthcare organizations are being asked to achieve a large number of strategic objectives during some very short time frames. From MACRA and meaningful use to pay-for-performance contracting and endless technology upgrades, executive leaders will have their hands full of competing initiatives for the foreseeable future.

While it may be tempting for the C-suite to simply order the rest of the organization to “fix it” and expect improvements in short order, few business improvement projects will succeed without clearly defined goals, manageable parameters, and a detailed roadmap for achieving success.

Providers large and small should start the planning process by gathering key stakeholders from across the organization, including leaders from the clinical, financial, IT, health information management, HR, logistics, and patient experience teams.

“The first thing to do is to list out everything that matters to everyone,” says Bharat Rao, Principal in KPMG’s Advisory Services.

Organizations may find that they have a laundry list of items from each department, every one of them a top priority for those concerned.

“It never hurts to make sure everything is on the table so that your roadmap can comprehensively address your organization’s concerns,” said Rao.

But the problems begin when organizations try to address all of those issues at the same time.

“You can’t do seventy things,” he stressed. “It’s not possible, even if you do happen to have the money. There cannot be accountability when you’re trying to change too many things at once. You have to focus on what’s most important, and by doing so, you will actually receive a great deal of the return you envisioned when you make that list of several dozen tasks.”

Providers may find, for example, that the patient flow technology they purchase to address weekend overcrowding in the emergency department can also help with allocating staff members at peak utilization times to prevent overworking nurses.

Well-rested nurses may reduce patient safety errors, thus lowering preventable readmissions and their associated quality penalties. Fewer avoidable readmissions means a higher quality ranking, which improves the organization’s reputation in the community and may lead to higher patient satisfaction and more revenue – all based on making one savvy purchase instead of creating half a dozen redundant initiatives.

Organizations must clearly understand the value chains they are trying to develop, however, and set benchmarks to monitor success at each step of the way.

“You need some vision of where you’re going, and you do need someone to drive the bus,” cautioned Rao.

The “bus driver” should be a high-level stakeholder, such as an executive leader with experience using data, dashboards, and reporting to drive measurable outcomes.

But executive leaders and champions for change should also have a clear understanding of how new processes will filter down the chain of command to the end user, asserts Rebecca Williams, RN, Care Coordination Management at St. Joseph Hospital.

“It’s very important to have your C-suite buy in, especially when they’re signing the purchase orders,” she said. “But don’t forget the end-users.”

Instead of simply implementing a slew of new reporting requirements or sending spreadsheets to departmental leaders and leaving the next steps to sort themselves out, a good business intelligence initiative includes follow-through.

“If you pick technologies or make choices and the end users don’t feel supported, your data isn’t going to be actionable,” Williams said. “You can’t just hand out the data and hope that the clinicians are going to do something with it.”

False starts, incomplete feedback loops, or poorly designed workflows can be costly and demoralizing, sapping commitment to long-term change and planting a seed of doubt in the minds of stakeholders.

To avoid a frustrating failure, organizations should spend adequate time on the goal-setting and buy-in stages before attempting to launch an ambitious project.

Top 10 Challenges of Big Data Analytics in Healthcare

Best Practices for Value-Based Purchasing Implementation

Identifying and measuring high-value use cases

In order to narrow down the list of ideas and start building programs that are likely to produce the most impactful results, healthcare organizations must understand what constitutes “value” and how to achieve it.

Key performance indicators (KPIs) provide organizations with a way to measure the impact of specific processes and outcomes by comparing baseline performance with changes over time.

KPIs can be used to create the scorecards and performance dashboards that inform decision-making and the development of best practices.

They often include a combination of process measures – whether or not a service or task was completed – and outcome measures, or how effectively that activity contributed to reaching an ultimate goal.

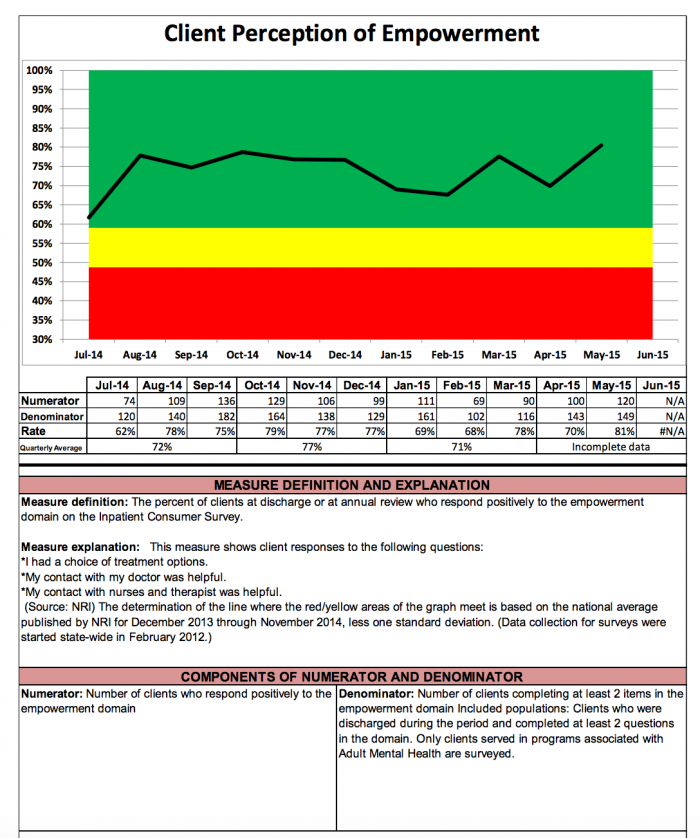

At Georgia’s Department of Behavioral Health and Developmental Disabilities (DBHDD), for example, KPIs related to patient outcomes after receiving treatment in hospital, community behavioral health and developmental disabilities systems of care provide clear insight into the state’s performance on critical patient care measures.

Source: Georgia DBHDD

The comprehensive report from 2015 includes distinctive color coding and clear visualization of performance as well as detailed explanations of what the measure means and what data is being used to develop the result.

Stakeholders can easily see that efforts to improve communication, patient engagement, and patient education are paying off for state facilities over time.

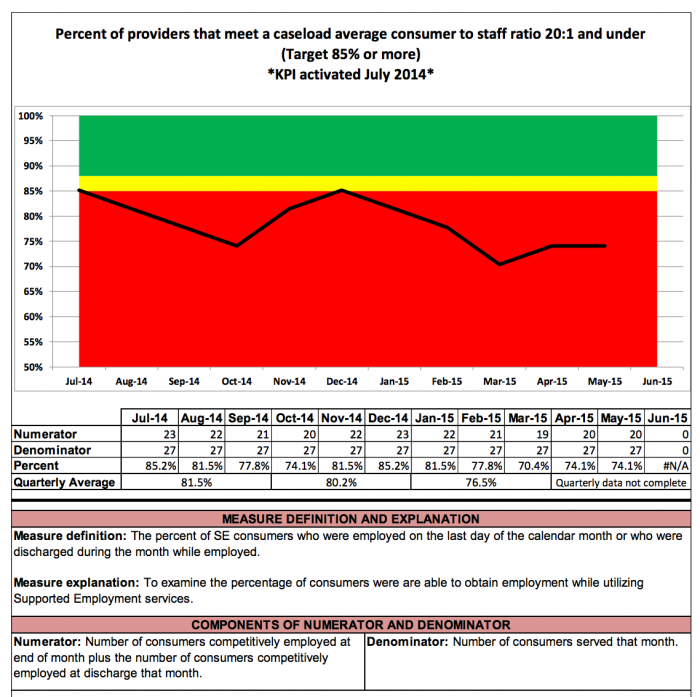

However, at the time, the state was struggling to meet its targets for the percentage of providers with acceptable case loads.

Source: Georgia DBHDD

In the report, DBHDD officials note that interviews with stakeholders revealed that frequent staff turn-over and a need for better education about procedures were contributing to the shortfall.

As a result, the department may be able to target their efforts in these areas to reduce burdens on providers and improve performance on this important indicator of care.

Key performance indicators can help healthcare organizations identify high-value projects and flag areas of concern across the three main domains of administration, clinical care, and financial operations.

Organizations may wish to develop KPIs to monitor progress and improve lackluster performance for the following use cases with wide-ranging impacts on quality, revenue, and satisfaction:

Staffing shortages

In 2016, more than 40 percent of respondents to an industry survey said they are struggling to meet their employment goals, with 72 percent noting an inadequate number of primary care providers and 51 percent in need of mid-level providers like nurse practitioners and physician assistants.

As the adoption of value-based reimbursement starts to change the model of care for hospitals, primary care practices, and others, healthcare organizations will need to ensure that they have the human resources to coordinate care, address population health management concerns, and meet the growing expectations of consumer-driven healthcare.

Supply chain management

The majority of supply chain management activities are still conducted manually, according to a recent Cardinal Health and SERMO poll, which may leave gaps in critical information required to reduce waste and streamline the supply management process.

Measuring utilization rates, ordering strategically to reduce the chance of stock going out-of-date, and ensuring standardization in the purchasing process can help to significantly reduce costs without adversely affecting patient care.

Patient flow and utilization

Healthcare providers are often extremely concerned with making sure that a patient receives an appointment that they will keep, which means that providers are usually run off their feet during certain popular times of day.

Using a business intelligence tool to understand these utilization patterns and allocate staff accordingly could result in shorter waiting times and more efficient use of resources.

Avoidable readmissions

Avoidable readmissions don’t just lower patient satisfaction and increase the risk of a negative outcome. They also carry significant quality penalties that can cost hospitals tens of thousands of dollars each year. Despite the fact that preventable readmissions are on the decline, hospitals are expected to pay more than $528 million in 2017 for quality issues related to speedy returns to the inpatient setting.

Organizations can target improvement activities to hand hygiene and infection prevention, patient education and discharge planning, monitoring patients at high risk for falling or wandering, and proactively identifying sepsis in order to reduce unnecessary readmissions.

Patient satisfaction

A high satisfaction score is an indication that healthcare organizations have gotten it right with the patient experience from start to finish. Communication, transparency, empathy, and respect are key competencies for providers who wish to instill loyalty in their patients.

“What we find is that loyalty is primarily being driven by communication,” says Joe Greskoviak, President and Chief Operating Officer at Press Ganey. “There’s a difference between waiting [to see a provider] and not knowing why you’re waiting.”

Hospitals already have HCAHPS scores to help them monitor their performance in this realm, but organizations are also encouraged to field internal surveys of patients to better understand if consumers feel supported throughout their interactions with providers, administrative staff, and other members of the care environment.

KPIs measuring patient registration times, insurance verification rates, and service pre-authorization factors can also give providers some insight into how efficiently they get patients into the system with the minimum amount of disruption, paperwork, and delay.

Claims management, denials, and A/R days

Successful revenue cycle management depends on a high degree of efficiency, short wait times between billing and reimbursement, and reducing the amount of uncompensated care delivered to patients. KPIs can be particularly helpful for financial officers, since numbers don’t lie, and a variety of pre-developed revenue cycle measurement metrics are available from organizations like the Healthcare Financial Management Association (HFMA).

Indicators such as did not final bill (DNFB), final bill not submitted (FBNS), did not submit to payer (DNSP), and clean claim rate can help ensure that claims are being generated efficiently.

Monitoring duplicate and repeat claims submissions, denial rates, and time from service delivery to final reimbursement can aid organizations as they gauge their available revenue streams and processing activities.

Providers may also wish to add clinical documentation improvement initiatives to their claims monitoring programs. Clean, complete, and accurate clinical documentation can prevent billing queries and denials for lack of specificity while ensuring that coders can attach the best possible ICD-10 code to claims to speed the reimbursement process.

System leakage and population health management

Value-based care requires healthcare organizations to maintain contact with their patients over the long-term, and rewards health systems that keep the majority of care within a close-knit provider network.

Keeping tabs on patients as they move across the care continuum – and identifying opportunities to provide as many services as possible to ensure patients receive their care from in-network providers – is an important part of achieving financial success in the accountable care environment.

In addition to monitoring patient utilization trends, building as much market share as possible, and coordinating closely with payers to identify and share risk appropriately, providers should investigate how to leverage population health management techniques to proactively deliver care to high-risk patients.

Patient-centered medical homes (PCMHs) can act as hubs for chronic disease patients, offering consumers a carefully managed way to engage with primary care, specialists, and hospitals when required.

Information can be more centralized and care planning more efficient when a single entity is in charge of coordinating services for high-needs patients, allowing health systems to keep data liquid and deliver financially advantageous care under risk-based contracts.

Leveraging Group Purchasing for Hospital Supply Chain Management

Understanding the Many V's of Healthcare Big Data Analytics

Assessing existing big data assets and health IT needs

While many of the aforementioned use cases could be addressed manually, health IT tools are quickly reshaping the way organizations gain access to actionable insights and critical business intelligence.

In the modern healthcare environment, almost all business intelligence initiatives will be driven by data analytics. Organizations must have a clear idea of what their data assets are, if they are accessible and interoperable, whether or not technology upgrades are required, and how to recruit the right experts to analyze data and build actionable reports.

Even with clear strategic goals in mind and a handful of KPIs to monitor, many healthcare organizations find that the business intelligence process gets very fuzzy once big data is involved.

“What we really need in order to improve outcomes is end-to-end visibility across the spectrum of care at a service line level,” said David Delaney, MD, Chief Medical Officer at SAP.

Yet healthcare organizations are still missing hard-to-hire analytics professionals to help them assess their data-driven initiatives, and continue to struggle with understanding what big data is, why it is so important, and how to create, store, and analyze it appropriately.

Providers seeking to take on one or more challenging business intelligence initiatives should ask themselves the following questions about their data science competencies:

- What specific use case am I targeting? What KPIs am I going to use to measure success? What data will be included in the numerator and denominator for that KPI?

- Do we have access to that necessary data set? Where does the data live? Is it duplicated across multiple departments or shared between divisions? Is the data defined in the same way across every location? If not, why? Which version do I wish to treat as the source of truth?

- Is the data complete, clean, accurate, and up to date? Is it in a format that can be easily manipulated?

- Do we have staff members in house who are skilled at performing analytics? If not, is it worth investigating an analytics-as-a-service platform or vendor?

- Can we use this data to produce analytics that are truly meaningful? Do our reports help to make decisions? Can we use the data to figure out why something is happening, not just if it is happening?

Healthcare organizations may find that they lack the health IT infrastructure to address these concerns, and that they need to invest in more tools to help them achieve their goals.

When looking to purchase a big data business intelligence platform or service, providers should consider these key concepts:

- Is this product built on open standards widely accepted by the industry? Does it accept or utilize APIs to connect easily with other systems? Will it connect with my systems?

- Are there hidden fees in the contracting structure for this offering? If the product is subscription based, will the pricing change over time?

- Who owns the data that moves through or is stored in this system? What are the procedures for and results of ending a partnership?

- Does this product or service use third-party outsourcing or cloud services? What are the entities involved, what part do they play, and do they meet industry security and operational standards?

- Is this product scalable and adaptable for my future needs? Can it accept new sources of data for more advanced analytics, or do I need to purchase additional tools or capabilities? How will this vendor grow with my organization and continue to provide support?

Data-driven business intelligence tools can significantly improve performance, outcomes, and revenue for providers who make smart partnerships with vendors and translate raw data into actionable insights.

Success requires organizations to understand what data can do for them – and what it can’t – when applying analytics to business problems, said Delaney.

“As the healthcare system starts to realize the importance of using data analytics to develop visibility into value, the marketplace will generate the tools required to innovate and make sure that every patient is receiving the best possible care along the right service lines,” he said.

“That’s when big data will really start to line up with patient interests. Ultimately, patients want to get healthier and stay healthier in a safe and cost-effective fashion. It’s the healthcare industry’s job to figure out how we can do that at scale for some very complex cases across the population.”

How to Choose the Right Healthcare Big Data Analytics Tools

Top Revenue Cycle Management Vendors and How to Select One